17+ north dakota paycheck calculator

17 north dakota paycheck calculator Senin 31 Oktober 2022 Edit. Calculate your North Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Dakota.

Employee Paycheck Calculator Worker Take Home Pay Calculator

Just enter the wages tax.

. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. North Dakota Hourly Paycheck Calculator. Get the best pay stub template for tax filing proof of income and other purposes.

To use our North Dakota Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. North Dakota Paycheck Calculator. Figure out your filing status work out your adjusted gross.

Well do the math for youall you need to do is. Get the best pay stub template for tax filing proof of income and other purposes. For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in North Dakota. The 2022 wage base is 147000. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

North Dakota Paycheck Calculator Use ADPs North Dakota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Must contain at least 4 different symbols. Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck calculator.

The state income tax rate in North Dakota is progressive and ranges from 11 to 29 while federal income tax rates range from 10 to 37 depending on your income. Ad Easily Run Your Own Pay Stubs and Payroll By Yourself. This free easy to use payroll calculator will calculate your take home pay.

The state is notable for its low income tax rates which range. North Dakota levies a progressive state income tax with five brackets based on income level. Supports hourly salary income and multiple pay.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. North Dakota Hourly Paycheck and Payroll Calculator. Ad Easily Run Your Own Pay Stubs and Payroll By Yourself.

Need help calculating paychecks. Overview of North Dakota Taxes. After a few seconds you will be provided with a full.

The North Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and. 017 for calendar year 2019 026 for calendar year 2020.

Paycheck Calculator Take Home Pay Calculator

Econ 2101 Wholework Answer Econ2101 Microeconomics 2 Unsw Thinkswap

Content Measurement Guide

38 Sample Financial Affidavit In Pdf Ms Word

Meadow Creek Apartments 12505 Sw North Dakota Street Tigard Or Rentcafe

Corporate Tax In The United States Wikipedia

Base Info

Florida Wage Calculator Minimum Wage Org

Wbjee Gnm Nursing Admission 2022 Online Application Eligibility Question Paper Download

Archive 2018 Top Tech Tidbits A Mind Vault Solutions Ltd Publication

Rules Tariff Ats

Free Paycheck Calculator Hourly Salary Usa Dremployee

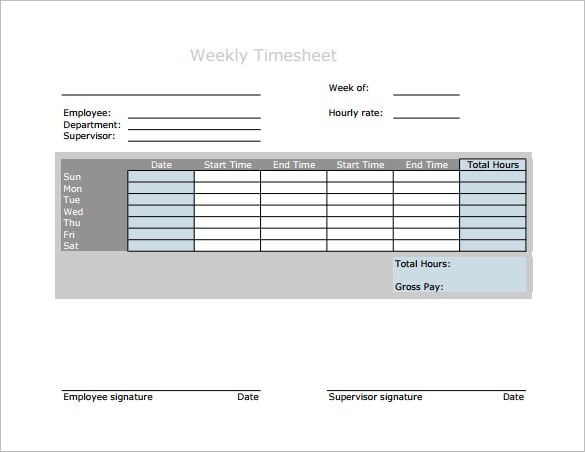

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Minnesota Wage Calculator Minimum Wage Org

Kentucky Houses For Sale Between 11 And 50 Acres 594 Listings Landwatch

Corporate Tax In The United States Wikipedia